Housing

Everybody in Canada (and elsewhere) deserves a roof over their head.

I’ve tried before to explain that the ‘housing crisis’ will not be solved by building millions more houses.

That logic simply defies basic economic principles in an oligopoly world: the creator of the product will always have a ‘floor’, or minimum price, at which they will sell the homes they build.

Developers will not suddenly start saying ‘we should sell our homes for 20% less than we were last year even though the cost of materials and labour continue to increase’.

Prices will not drop or even stabilize. We need to stop spreading the meme that more houses will translate to more affordability.

Canada is an amazing country and many investors in real estate see it as a STABLE country.

That’s why companies like Blackrock, Vanguard and pension funds along with rental platforms like AirBnB and VRBO love Canada.

Your pension fund company is probably also pushing you out of the market.

Why?

Canadian real estate, especially residential properties, represent an amazing place to park cash.

As our governments continue to plow onwards ignoring the fundamentals of supply and demand, we’ll just keeping building homes and apartments for the people who have the most money.

Individuals will never have a fair shake at getting an affordable home until our governments intervene and STOP supply from getting hoarded by a handful of investors.

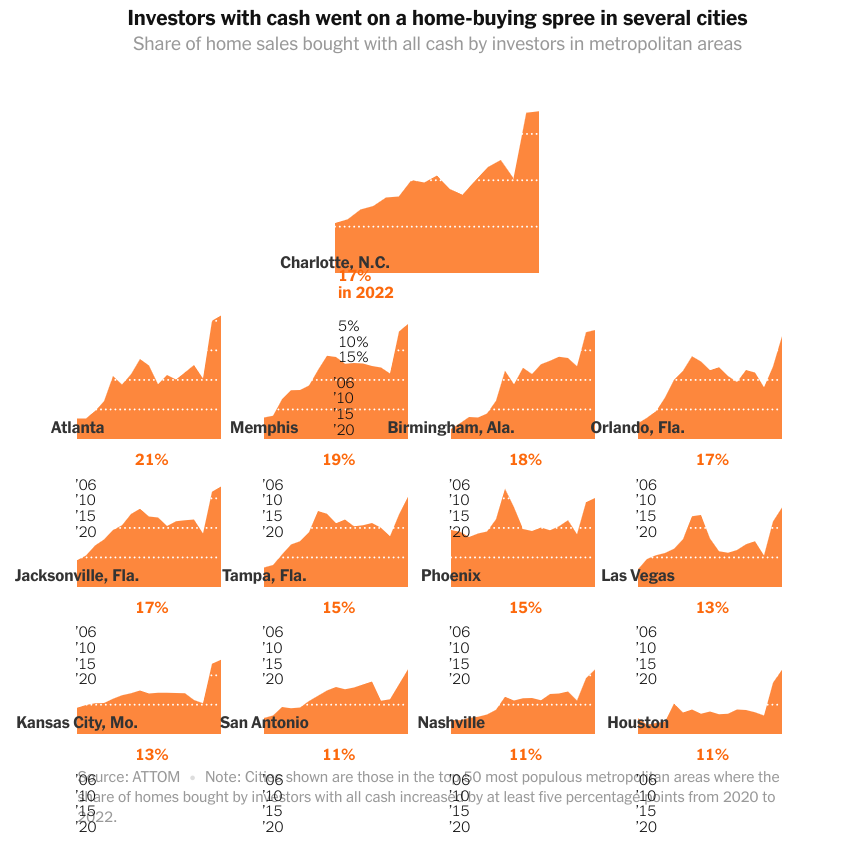

This is not just a Canadian problem.

Americans and Europeans are feeling the pinch as well.

This article from the New York Times sheds light on the idea that housing issues were not created by Justin Trudeau, as the idiot in the opposition would try to have Canadians believe. Here’s a link to the non-paywall version.

Wall Street is the crux of the problem.

Until we put a stop to this, we’ll just be chasing our own tails, yelling at everyone, plowing over farm land and not solving the problem.

Foreign and corporate investment in residential housing must be capped immediately.